Give your family the gift of a tax-free wealth transfer

You’ve worked hard for your wealth and want to leave a legacy for generations to come.

You already have excess wealth that you plan to pass on to the next two generations. You want them taken care of financially and have likely set aside a portion of your investment portfolio for them. One issue that arises is that all non-registered investment growth is drastically altered by taxation.

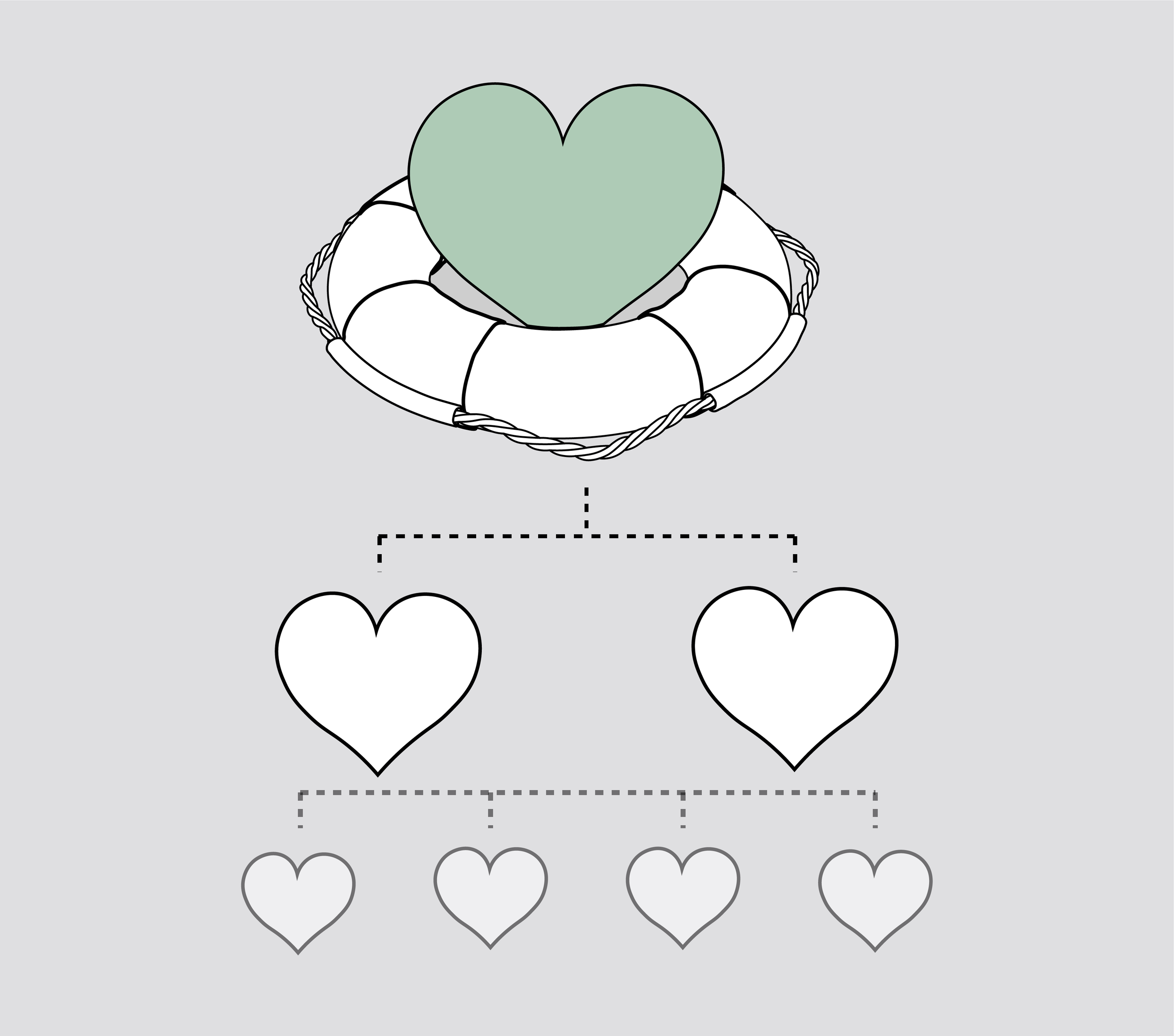

A tax-free permanent insurance policy can make sure your financial legacy extends all the way to your grandchildren.

Have you considered a generational wealth transfer using permanent life insurance? You can establish an insurance policy on your adult child or young grandchild where investment growth is not subject to annual taxation. As the owner of the plan, you control the money growing inside and can access it during your lifetime if needed. You grow your own wealth while securing a tax-free inheritance avenue – a win-win situation! Now you must be wondering, how does this work?

Purchasing for your Adult Child

When you purchase the plan and insure your child, they have a valuable asset right away: life insurance protection. You can transfer the policy to them at any time tax-free, however most people will transfer the policy at the time of their passing. This is done seamlessly by naming them as a contingent owner on the plan. As the new owner, they now have access to all the money that has been growing inside the policy. This money can be used to help buy a home, supplement their retirement, or help fund their child’s education. By naming your grandchild as beneficiary on this policy you have helped put a foundation in place they can build on as well. In the future, at the time your adult child’s passing, your grandchild will receive the death benefit proceeds tax-free creating wealth that last generations.

Things to keep in mind:

Only one child can be on the life insurance policy

This is for your adult child to benefit from the investment growth cash of the policy

Your grandchild will receive the death benefit payout creating a generational wealth transfer

You should consider having a trust set up for any minor beneficiaries

Purchasing for your Grandchild

You can alternatively choose to purchase a policy for your grandchild with the intention for them to benefit from the investment cash value of the policy and naming yourself or your child (grandchild’s parent) as the irrevocable beneficiary. This is a similar process of purchasing for your adult child; by naming your grandchild as the contingent plan owner the policy will be transferred to them when they reach an appropriate age. The growth in the policy's cash value can be used by your grandchild for life expenses such as education or purchasing their first home. On top of other benefits, establishing life insurance for a young child guarantees their insurability from a young age and begins with very low premiums.

Things to keep in mind:

Only one grandchild can be on the life insurance policy

This is for your grandchild to benefit from the investment growth cash of the policy

The younger they are when insurance is purchased, the lower their premium will be

Guarantees grandchild’s insurability for the future

This is a highly efficient way to extend your financial legacy regardless of which plan suits your family; ensure your loved ones get the most of your hard-earned wealth for generations to come without the burden of taxation.

This is a sophisticated strategy that should be implemented with the guidance of your accountant and/or lawyer. In collaborating with them, we will do the required due diligence to ensure you remain compliant within CRA guidelines for the present day and in the future. Commonly deployed by high net-worth individuals, this strategy should be set up and administered under professional supervision only, by tax and estate specialized (CLU®) advisors.

Case Study

Joe is 60 years old and has worked hard to build his wealth. He wants to set aside a portion of his wealth for his daughter Lisa and her daughter Marie (Joe’s grandchild).

Joe takes out a permanent life insurance policy with a savings component on Lisa, naming her the contingent owner of the policy. This way Joe still has access to money in this policy if needed. Joe makes annual deposits of $10k for 10 years to create capital in the policy.

Joe can transfer the full policy ownership to Lisa at any time allowing her full access the cash growth component to use on life milestones such as a home purchase, supplementing her retirement, or helping fund her child’s education.

30 years later, upon Joe's passing, Lisa will be the owner of her policy with a cash value of $275,000 and a death benefit of $750,000.

Once Marie is older, her daughter will be the beneficiary of the death benefit making the wealth transfer tax-free for two generations. Should Lisa live to 90 and not need to access cash in the policy, the tax-free benefit paid out to Marie would be over $1.45M (at todays rates).

This achieves a tax-free generational wealth transfer vehicle for Joe giving him peace of mind that he was able to gift his family an inheritance that is not venerable to taxation. This also provides life insurance coverage for Joe’s daughter giving her family protection from the unforeseeable. This was a great way to utilize $100k in which he already planned on leaving to the next generation.