Critical Illness – a Win-Win Protection and Savings Plan

Most people will make it to retirement without suffering a major illness…but there is always a risk the unexpected can happen. Do you have a plan to protect your finances if you get ill?

Sure, you could use your savings or take out a loan to cover the unexpected costs, however, both options will have a significant impact on your retirement plans. If you need to access your registered funds, they are taxed in the year you use them. Accessing those funds prior to retirement should not part of your plan.

Pass on that risk onto an insurance company. They will take care of the rest with an illness recovery benefit. This is a tax-free lumpsum payment to cover any number of unforeseen expenses. No need to submit receipts or to justify the costs.

Keep your retirement goals on track with critical illness insurance.

If you are diagnosed and survive a major illness like cancer, heart attack or stroke, you receive an illness recovery benefit payment. This will keep your retirement goals on track.

Below is an example of a typical 40-year-old, on track, saving for retirement.

After diagnosis, they will need to access $100k from their registered account at age 55 to cover additional costs associated with fighting an unfortunate cancer diagnosis. The impact is significant:

Take 1% of your annual rate of return to pay the premium. Your future self and family will be grateful if the worst happens.

You may be thinking, what happens if I don’t get seriously ill? Does my premium money go to waste? Great news – no it does not; Critical Illness insurance is a win-win!

One of the unique features in the Canadian Living Benefit insurance market is the ability to receive all your premiums back if you don’t claim on the contract.

With this product, you get a cheque from the insurance company for every premium dollar you paid over the life of the contract. There is no other insurance product that allows you to receive all your premiums back if you don’t use it.

Let’s look at an example of a typical 40-year-old female.

In the below example, during the 35 years of coverage, she is entitled to $100,000 if she survives a major illness such as cancer, heart attack, or stroke. There are many more covered conditions, however these three are the most common that people will claim on. If she does not develop a major illness, she will receive her total premium paid back as a lumpsum of $59,500 at age 75.

Here's the way we look at it - if you're accumulating $100-$200 per month in your chequing or savings accounts you might as well accumulate it in a Critical Illness (savings account). You'll have peace of mind and also untouched savings if you don't make a claim.

Critical Illness is a solution to protect you and your family from the unexpected. Regardless of if you get ill or not you will receive the benefit of financial security in your time of need or have a lumpsum of savings to add to your retirement. There are many ways to set up a Critical Illness policy and the return of premium benefit so it is tailored to your lifestyle. It is important to talk with an advisor about what type of policy and amount of coverage is best for you.

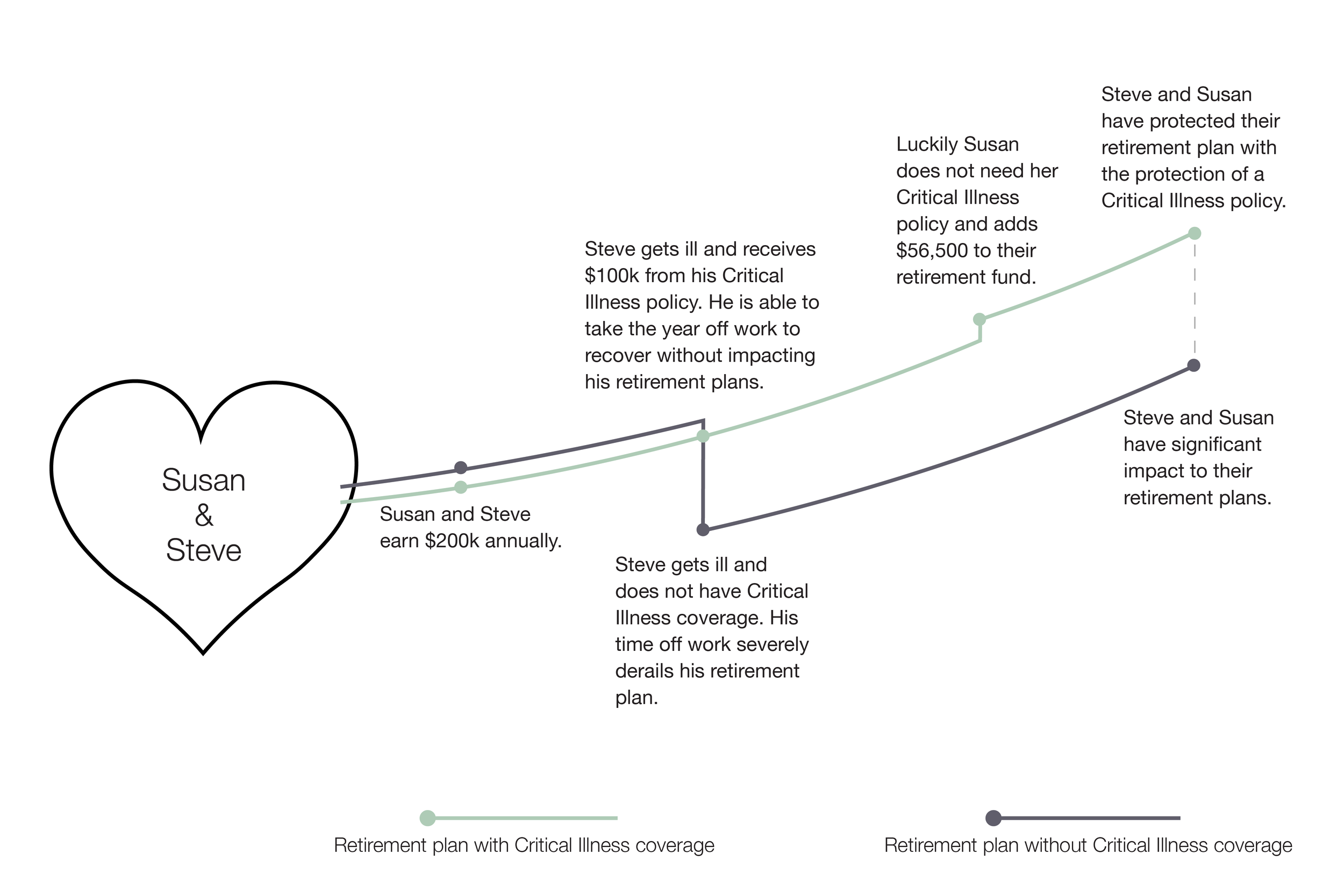

Case Study

Susan and Steve are in their 30’s and both have jobs that bring in a comfortable income (~$200k) to support their family. They want to be protected in case an unexpected major illness occurs to either of them that will affects their finances – specifically their retirement plan.

They both take out a Critical Illness policy for $100k of coverage each.

14 years later Steve has a sudden heart attack that effects his ability to work for a period of time. Luckily, his Critical Illness policy paid him out a lumpsum of $100k so he was able to recover without a burden on his finances and kept their retirement goals on track.

Many years later Susan, now 75, was lucky enough to not experience any serious illness where she needed a payout from her Critical Illness policy. Her policy came to an end and she received a tax-free cheque of $56,500 to add to their retirement fund.

Susan and Steve went through life with peace of mind knowing they protected themselves from the unexpected and whether they got sick or not both benefited from proper planning and a Critical Illness policy.